UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| (Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Stran & Company, Inc.

500 Victory Road, Suite 301

Quincy, MA 02171

NOTICE OF COMBINED 2024 AND 2025 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 25, 2025

Dear Stockholder:

We are pleased to invite you to attend the Combined 2024 and 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Stran & Company, Inc., a Nevada corporation (“Stran,” the “Company,” “we,” “us,” or “our”), which will be held on July 25, 2025 at 1:00 p.m., Eastern Standard Time, for the following purposes:

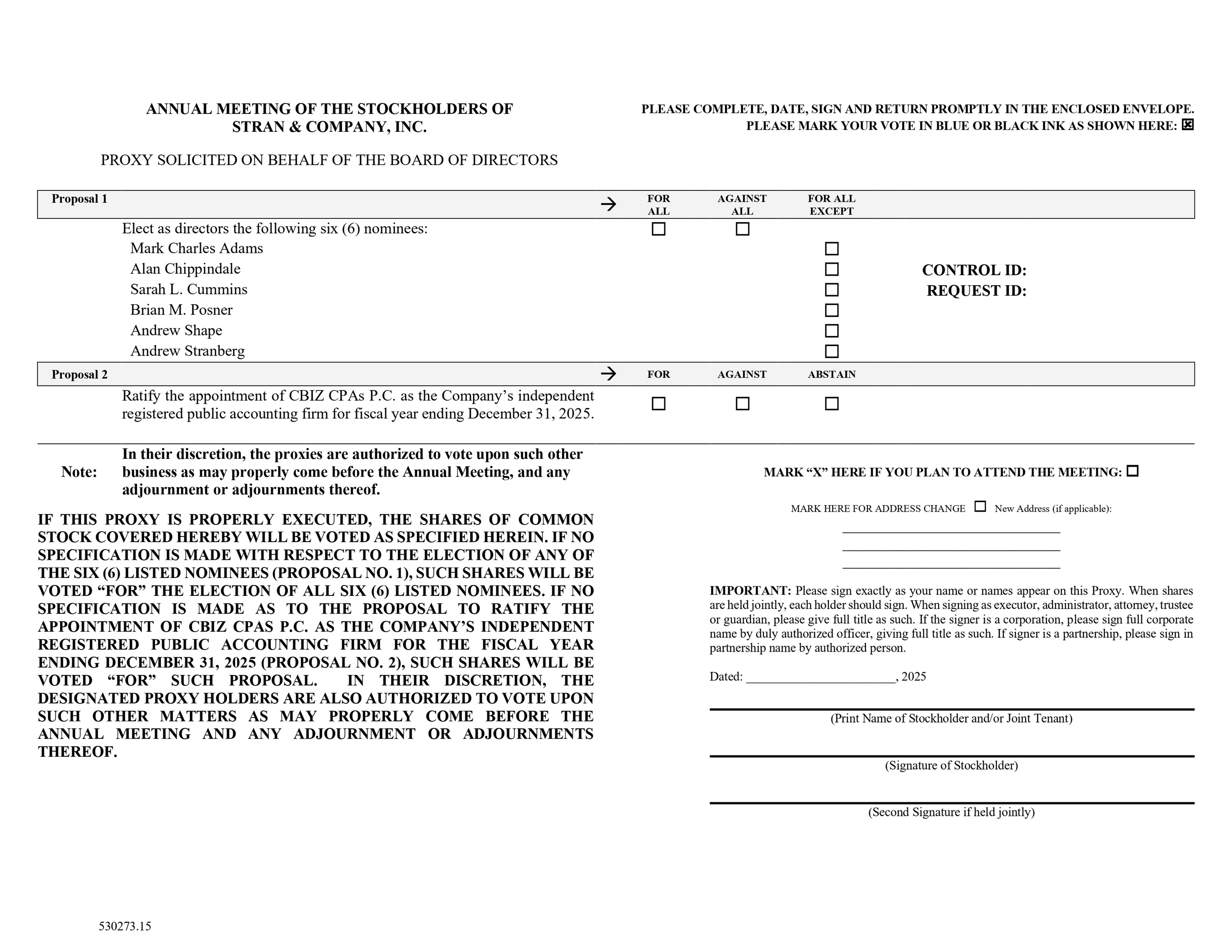

1. To elect the six (6) nominees named in the accompanying proxy statement to our board of directors (the “Board of Directors” or the “Board”) to hold office until the 2026 Annual Meeting of Stockholders (the “2026 Annual Meeting”); and

2. To ratify the appointment of CBIZ CPAs P.C. as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2025.

3. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this notice or made available over the Internet. We are not aware of any other business to come before the Annual Meeting.

The Board of Directors has fixed the close of business on May 27, 2025 as the record date (the “Record Date”) for a determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only stockholders of record at the close of business on May 27, 2025 are entitled to notice and to vote at the Annual Meeting and any adjournment or postponement thereof.

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the annual meeting online, vote your shares electronically or submit your questions prior to and during the meeting by visiting the website(s) indicated in your proxy materials. You may need to have your control number included on your proxy card or on the instructions that accompanied your proxy materials or other information as instructed through your broker, bank or other holder of record to join the annual meeting. There will be no physical location for stockholders to attend, and you will not be able to attend the annual meeting in person.

It is important that your shares are represented at the Annual Meeting. We urge you to review the attached proxy statement and, whether or not you plan to attend the Annual Meeting, please vote your shares promptly by casting your vote via the Internet or any other provided voting option, or, if you receive a full set of proxy materials by mail or request one be mailed to you, and prefer to mail your proxy or voter instructions, please complete, sign, date, and return your proxy or vote instruction form in the pre-addressed envelope provided, which requires no additional postage if mailed in the United States. You may revoke your vote by submitting a subsequent vote over the Internet, by mail or by any other option provided for voting before the Annual Meeting, or by voting electronically at the Annual Meeting.

| By Order of the Board of Directors | |

| Dated: July 11, 2025 | /s/ Andrew Stranberg |

| Andrew Stranberg | |

| Executive Chairman, Secretary and Treasurer |

Important Notice Regarding the Availability of Proxy Materials for the Combined 2024 and 2025 Annual Meeting to Be Held on July 25, 2025: Our proxy statement and annual report to security holders for the year ended December 31, 2024 are available at https://www.iproxydirect.com/SWAG.

TABLE OF CONTENTS

i

PROXY STATEMENT

COMBINED 2024 AND 2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON July 25, 2025

This proxy statement and the accompanying proxy are being furnished with respect to the solicitation of proxies by the Board of Directors for the Annual Meeting. The Annual Meeting is to be held as a virtual meeting at 1:00 p.m., Eastern Standard Time, on Friday, July 25, 2025, and at any adjournment(s) or postponement(s) thereof.

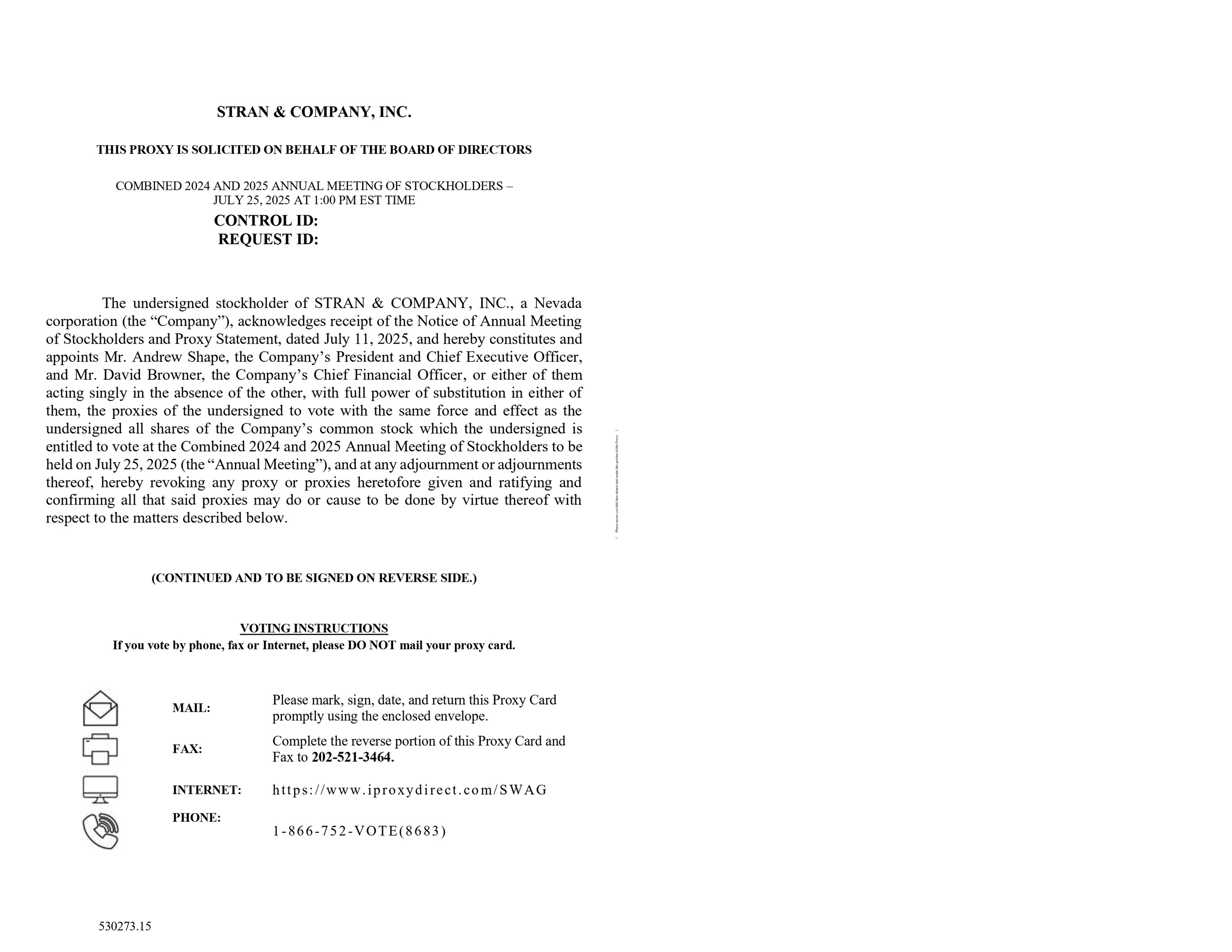

The approximate date on which the proxy statement and the accompanying notice and form of proxy are intended to be sent or made available to stockholders is on or about July 11, 2025. A proxy is your legal designation of another person to vote the stock you own. That designee is referred to as a proxy holder. Designation of a particular proxy holder can be effected by completion of a written proxy, or by voting via the Internet or by another provided voting option. If you return a proxy or vote by the Internet or other provided voting option, Andrew Shape, our President and Chief Executive Officer, and David Browner, our Chief Financial Officer, will act as your designated proxy holders for the Annual Meeting and will vote your shares at the Annual Meeting as you have instructed them on the proxy. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

What is a proxy statement?

A proxy statement is a document that we are required by regulations of the Securities and Exchange Commission (the “SEC”), to give you when we ask you to provide a proxy to vote your shares at the Annual Meeting. Among other things, this proxy statement describes the proposals on which stockholders will be voting and provides information about us.

We are soliciting your proxy to vote at the Annual Meeting and at any adjournment or postponement of the Annual Meeting. We will use the proxies received in connection with proposals to:

| 1. | elect the six (6) nominees named in this proxy statement to the Board of Directors to hold office until the 2026 Annual Meeting; and | |

| 2. | ratify the appointment of CBIZ CPAs P.C. as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2025. |

How do I attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date. If your shares are held in the name of a broker, bank, or other nominee, you should follow the instructions provided by your broker, bank, or other nominee in order to participate in the virtual Annual Meeting. No physical meeting will be held.

You will be able to attend the virtual Annual Meeting online and submit your questions during the meeting by visiting the website indicated in your proxy card or on the instructions that accompanied your proxy materials. You also will be able to vote your shares online by attending the virtual Annual Meeting. To participate in the Annual Meeting, you may need the control number included on your proxy card or on the instructions that accompanied your proxy materials or other information as instructed through your broker, bank or other holder of record. Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. If your shares are held in the name of a broker, bank, or other nominee, you should contact your broker, bank, or other nominee to obtain your control number or other instructions provided by your broker, bank or other holder of record. However, even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

1

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting website. If you encounter any difficulties accessing the virtual Annual Meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

Who may attend the Annual Meeting?

Only record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting.

Who is entitled to vote?

The Board has fixed the close of business on May 27, 2025 as the Record Date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only stockholders who owned our common stock on the Record Date are entitled to vote at the Annual Meeting. Each stockholder who owned our common stock on the Record Date is entitled to one vote per share owned on that date. On the Record Date, there were 18,608,408 shares of our common stock outstanding, and which were entitled to a total of 18,608,408 votes.

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, VStock Transfer, LLC, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been or may be provided directly to you by the Company or its proxy delivery service.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares in “street name.” If your shares are held in street name, these proxy materials have been or may be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. The majority of our stockholders hold their shares in street name.

What am I voting on?

There are two (2) proposals scheduled for a vote:

1. To elect the six (6) nominees named in this proxy statement to the Board of Directors to hold office until the 2026 Annual Meeting; and

2. To ratify the appointment of CBIZ CPAs P.C. as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2025.

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, your proxy gives authority to the designated proxy holders to vote on such matters according to their best judgment.

2

How do I vote?

Stockholders of Record

Record holders of our common stock have five methods of voting:

1. Vote by Internet. You may vote by using the Internet in accordance with the instructions provided on your Notice of Internet Availability of Proxy Materials or proxy card.

2. Vote by Mail. To vote by mail, please mark, date, sign and promptly mail your proxy card (a postage-paid envelope is provided for mailing in the United States). If you only received a Notice of Internet Availability of Proxy Materials, you may request a proxy card by following the instructions provided.

3. Vote by Phone. The telephone number for voting by phone is on your proxy card that you received or may request by following the instructions provided in your Notice of Internet Availability of Proxy Materials.

4. Vote by Fax. The fax number for voting by fax is on your proxy card that you received or may request by following the instructions provided in your Notice of Internet Availability of Proxy Materials.

5. Vote Electronically at the Virtual Annual Meeting. Attend and vote at the virtual Annual Meeting. To participate in the Annual Meeting, you may need the control number included on your proxy card or other information on the instructions that accompanied your proxy materials.

Beneficial Owners of Shares Held in Street Name

Beneficial owners of our common stock also have five methods of voting:

1. Vote by Internet. You may vote by using the Internet in accordance with the instructions provided on your Notice of Internet Availability of Proxy Materials or vote instruction form.

2. Vote by Mail. Mark, date, sign and promptly mail your vote instruction form (a postage-paid envelope is provided for mailing in the United States). If you only received a Notice of Internet Availability of Proxy Materials, you may request a vote instruction form by following the instructions provided in your Notice of Internet Availability of Proxy Materials.

3. Vote by Phone. The telephone number for voting by phone is on your vote instruction form that you received or may request by following the instructions provided in your Notice of Internet Availability of Proxy Materials.

4. Vote by Fax. The fax number for voting by fax is on your vote instruction form that you received or may request by following the instructions provided in your Notice of Internet Availability of Proxy Materials.

5. Vote Electronically at the Virtual Annual Meeting. Attend and vote at the virtual Annual Meeting. Your broker, bank, or other nominee will provide any necessary control number or other voting instructions.

When must my votes be received by?

All shares entitled to vote and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked will be voted at the Annual Meeting as instructed in a proxy delivered before the Annual Meeting. If you wish to vote at the Annual Meeting, see “How do I attend the Annual Meeting?” above. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

We are providing Internet as well as telephone and fax proxy voting options to all stockholders. We are also holding the Annual Meeting virtually to allow you to attend the Annual Meeting and vote your shares during the Annual Meeting online. However, please be aware that you must bear any third-party costs, such as usage charges from Internet access providers and telephone companies.

3

How many votes do I have?

Each share of our common stock that you owned as of May 27, 2025 entitles you to one vote.

Is my vote confidential?

Yes, your vote is confidential. Only the proxy tabulator, inspector of election, designated proxies, and other persons who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

How will my shares be voted if I give no specific instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

| 1. | “FOR” the election of each of the six (6) nominees named in this proxy statement to the Board of Directors to hold office until the 2026 Annual Meeting; and |

| 2. | “FOR” the ratification of the appointment of CBIZ CPAs P.C. as our independent registered public accounting firm for our fiscal year ending December 31, 2025. |

This authorization would exist, for example, if a stockholder of record merely signs, dates and returns their proxy card but does not indicate how its shares are to be voted on one or more proposals. If other matters properly come before the Annual Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of the proxies.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “FOR,” “WITHHOLD” and broker non-votes; and, with respect to the other proposal, votes “FOR,” “AGAINST,” “ABSTAIN,” and broker non-votes.

What is the effect of a withhold vote?

Withhold votes will have no legal effect on the election of directors because such elections are by a plurality. Withhold votes will be counted as shares present and entitled to vote for purposes of determining a quorum.

What is a broker non-vote?

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker, bank, trustee or other nominee with voting instructions, your shares may constitute “broker non-votes”. Broker non-votes occur on a matter when the broker, bank, trustee or other nominee is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters.

Proposal No. 1 is considered a “non-routine” matter, while Proposal No. 2 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal No. 1, and a broker non-vote will occur on this matter. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Because Proposal No. 2 is a “routine” matter, a broker, bank, trustee or other nominee may be permitted to exercise its discretion on this proposal, which means there will be no broker non-votes on this matter. Broker non-votes will be counted as shares present for purposes of determining a quorum to the extent that the brokers, banks, trustees or other nominees use their discretionary authority to vote such shares on Proposal No. 2.

4

What is an abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Nevada law, abstentions are counted as shares present and entitled to vote at the Annual Meeting, and therefore will be counted for purposes of determining a quorum. Generally, unless otherwise provided by applicable law, our Amended and Restated Bylaws (“Bylaws”) provide that an action of our stockholders (other than the election of directors) is approved if a majority of the number of shares of stock entitled to vote thereon and present (either by attending the meeting electronically or by proxy) vote in favor of such action. Therefore, votes marked as “ABSTAIN” will have the same effect as a vote “AGAINST” the outcome in Proposal No. 2. Votes marked as “ABSTAIN” on Proposal No. 1 will have no effect because directors are elected by plurality voting.

How many shares must be present or represented to conduct business at the Annual Meeting?

A “quorum” is necessary to conduct business at the Annual Meeting. A quorum is established if there is the presence by attendance electronically or by proxy of the holders of a majority of the voting power at the Annual Meeting. Shares owned by the Company are not considered outstanding or considered to be present at the Annual Meeting. Abstentions will be counted as present for purposes of determining a quorum at the Annual Meeting. Similarly, broker non-votes will be counted as present for purposes of determining a quorum at the Annual Meeting to the extent that the brokers, banks, trustees or other nominees use their discretionary authority to vote such shares on Proposal No. 2. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

How many votes are needed for each proposal to pass?

| Proposal | Vote Required | |

| Election of the six (6) nominees named in this proxy statement to the Board of Directors to hold office until the 2026 Annual Meeting | Plurality of the votes cast, meaning that the six (6) nominees receiving the most “FOR” votes will be elected. | |

| Ratification of the appointment of CBIZ CPAs P.C. as our independent registered public accounting firm for our fiscal year ending December 31, 2025 | The number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. |

What are the voting procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or vote in favor of specific nominees and withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the proxy card or vote instruction form that was delivered to you or that you may request by following the information in your Notice of Internet Availability of Proxy Materials.

Can I change my vote or revoke my proxy?

If you are a stockholder of record, you may revoke your proxy at any time prior to the vote at the Annual Meeting. If you submitted your proxy by mail, you must file with our Secretary a written notice of revocation or deliver, prior to the vote at the Annual Meeting, a valid, later-dated proxy. If you submitted your proxy by the Internet, you may revoke your proxy with a later Internet proxy. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Company’s Secretary before the proxy is exercised or you vote electronically at the Annual Meeting. If you are a beneficial owner, you may vote by submitting new voting instructions to your broker, bank or nominee, or, if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares, by attending the meeting and voting electronically.

Who is paying for the expenses involved in preparing and mailing this proxy statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.

5

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Do the Company’s officers and directors have an interest in any of the matters to be acted upon at the Annual Meeting?

Each of the members of the Board has an interest in Proposal No. 1, the election to the Board of the six (6) nominees named in this proxy statement. Each of the director nominees are currently members of the Board, and director nominees Andrew Shape and Andrew Stranberg are currently executive officers of the Company and members of the Board. Members of the Board and executive officers of the Company do not have any interest in Proposal No. 2, the ratification of the appointment of CBIZ CPAs P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice of Internet Availability of Proxy Materials and, if applicable, the annual report to security holders and proxy statement, to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate Notices of Internet Availability of Proxy Materials and, if applicable, the annual report to security holders and proxy statement. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, the annual report to security holders and proxy statement to any stockholder at a shared address to which we delivered a single copy of any of these documents or who wishes to receive separate copies of these documents in the future. To receive a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, the annual report to security holders and proxy statement, stockholders may contact:

Office of the Secretary

Stran & Company, Inc.

500 Victory Road, Suite 301

Quincy, MA 02171

Telephone: (800) 833-3309

Stockholders sharing an address can also request delivery of a single copy of the Notice of Internet Availability of Proxy Materials and, if applicable, the annual report to security holders and proxy statement if they are receiving multiple copies of annual reports to security holders, proxy statements, or Notices of Internet Availability of Proxy Materials, by contacting the address or telephone number above.

Stockholders who hold shares in street name (as described above) may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Whom should I contact with other questions?

You may obtain information from us by making a request by telephone or in writing at the address of the Company’s Secretary set forth above.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will be voting on the election of the six (6) nominees named in this proxy statement to the Board to hold office until the 2026 Annual Meeting. Directors are elected by a plurality of votes cast by stockholders. In the event that the elected nominees are unable or unwilling to serve as directors at the time of the Annual Meeting, the proxies will be voted for any substitute nominees designated by the present Board or the proxy holders to fill such vacancy, or for the balance of the nominees named without nomination of a substitute, or the size of the Board will be reduced in accordance with the Bylaws of the Company. The Board has no reason to believe that the persons named below will be unable or unwilling to serve as nominees or as directors if elected.

Assuming a quorum is present, the six (6) nominees receiving the highest number of affirmative votes of shares entitled to be voted for such persons will be elected as directors of the Company to serve for a one-year term. Unless marked otherwise, proxies received will be voted “FOR” the election of the nominees named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of the nominees listed below, and, in such event, the specific nominees to be voted for will be determined by the proxy holders, unless instructions are given to the contrary.

Information with Respect to Director Nominees

Listed below are the director nominees who are nominated to hold office until the 2026 Annual Meeting, and their ages as of the date of this proxy statement:

| Name | Age | |

| Mark Charles Adams | 63 | |

| Alan Chippindale | 66 | |

| Sarah L. Cummins | 52 | |

| Brian M. Posner | 63 | |

| Andrew Shape | 52 | |

| Andrew Stranberg | 53 |

The names of the nominees and certain biographical information about each current director standing for election at the Annual Meeting, including a description of his or her business experience, qualifications, education and skills that led the Board to conclude that such individual should serve as a member of the Board, are set forth below:

Mark Charles Adams has been a director of the Company since June 2025. Since March 2014, Mr. Adams has served as the President and Chief Executive Officer of Adams Publishing Group LLC. Since June 2022, Mr. Adams has served on the board of directors of the Associated Press. Since March 2021, Mr. Adams has served on the board of directors of News/Media Alliance. Since May 2008, Mr. Adams has served on the board of directors of The McCallum Theater. Since May 2024, Mr. Adams has served on the board of directors of DAP Health Inc. Mr. Adams has a Bachelor of Arts degree in Economics from Tufts University, a Master of Business Administration degree from Boston University, and a Master of Science in Business and Communications from Boston University.

We believe that Mr. Adams is qualified to serve on the Board due to his experience in media, publishing, and private equity.

Alan Chippindale has been a director of the Company since November 2021. Mr. Chippindale has been President of Engage & Excel Enterprises Inc. (“Engage & Excel”) since July 2017. From January 2008 to June 2017, Mr. Chippindale was Chief Business Development Officer of BrandAlliance Inc. Mr. Chippindale was President of Proforma Inc. from September 1987 to December 2004. Mr. Chippindale graduated from Bowling Green State University with a bachelor degree in International Business and Marketing.

7

We believe that Mr. Chippindale is qualified to serve on the Board of Directors due to his leading role in the promotional products industry.

Sarah L. Cummins has been a director of the Company since June 2025. Since July 2024, Ms. Cummins has served as Senior Vice President, Global Partnerships at WTA Ventures LLC, the commercial arm of the Women’s Tennis Association. From February 2023 to July 2024, Ms. Cummins served as an Operating Partner at Isos7 Sports. From February 2022 to July 2024, Ms. Cummins was the founder and Chief Executive Officer of Cashmere Ventures, LLC, a boutique sports consulting firm. From December 2018 to January 2022, Ms. Cummins served as Senior Vice President, Consumer Products at World Wrestling Entertainment, Inc. (NYSE: WWE). From January 2013 to November 2018, Ms. Cummins was Head of Business Development & Strategic Partnerships at New York Road Runners, Inc. From August 2010 to October 2012, Ms. Cummins served as Vice President at Vineyard Vines LLC. From 1996 to August 2010, Ms. Cummins was Managing Director at the United States Tennis Association (USTA). Ms. Cummins graduated from Boston College with a Bachelor of Arts in English.

We believe that Ms. Cummins is qualified to serve on the Board due to her extensive experience in business development, strategic partnerships, brand management, and executive leadership across the sports, entertainment, and consumer products industries.

Brian M. Posner has been a director of the Company since July 2025. Mr. Posner has served as a director of Firefly Neuroscience, Inc. (Nasdaq: AIFF) since August 2024. From April 2019 to October 2024, Mr. Posner was the Chief Financial Officer of electroCore, Inc. (Nasdaq: ECOR). Since October 2024, Mr. Posner has provided financial and accounting consulting services to electroCore. Mr. Posner currently serves as a consultant to electroCore. From April 2018 to March 2019, Mr. Posner served as the Chief Financial Officer of Cellectar Biosciences, Inc. (Nasdaq: CLRB). Mr. Posner holds an undergraduate degree in accounting from Queens College and an M.B.A. in managerial accounting from Pace University.

We believe that Mr. Posner is qualified to serve on the Board of Directors due to his public company audit committee and chief financial officer experience.

Andrew Shape is our co-founder and since 1996 has served as our President and director, and as our Chief Executive Officer since January 2020. From July 2018 to February 2021, Mr. Shape also served as the Chief Executive Officer and President and a director of Long Blockchain Corp. (formerly OTC Pink: LBCC), in connection with a business co-managed with us for its subsidiary Stran Loyalty Group Inc., a Delaware corporation. From June 2018 through December 2021, Mr. Shape served as a director for Naked Brand Group Limited (formerly Nasdaq: NAKD) until the closing of its business combination with Cenntro Electric Group Limited (Nasdaq: CENN). Prior to forming Stran, from August 1995 to September 1996, Mr. Shape worked at Copithorne & Bellows Public Relations (a Porter Novelli company) as an Account Executive. Mr. Shape holds a BA degree from the University of New Hampshire.

We believe that Mr. Shape is qualified to serve on the Board of Directors due to his deep knowledge of Stran, his industry expertise, and his experience as a director of other public companies.

Andrew Stranberg co-founded the Company and has served as our Executive Chairman since 1995. From 1995 to January 2020, Mr. Stranberg was also our Chief Executive Officer. In 1995, Mr. Stranberg founded Stran Capital LLC, a family office, and has since been its Chief Executive Officer. From 1997 to 2016 Mr. Stranberg served as Chairman of STRAN Technologies IT Services, LLC. From 2012 to November 2019, Mr. Stranberg was the founder and manager of Stran Maritime LLC for a joint venture with Atlas Maritime Ltd., an international shipping company. Mr. Stranberg is a graduate of the University of New Hampshire Peter T. Paul College of Business and Economics.

8

We believe that Mr. Stranberg is qualified to serve on the Board of Directors due to his deep knowledge of Stran and his long executive and board experience with us since his co-founding of the Company.

Our directors currently have terms which will end at the Annual Meeting or when their successors are elected and qualified, subject to their prior death, resignation or removal. Officers serve at the discretion of the Board of Directors. There is no arrangement or understanding between any director or executive officer and any other person pursuant to which he or she was or is to be selected as a director, nominee or officer.

The Nominating and Corporate Governance Committee of the Board (the “Nominating and Corporate Governance Committee”), the members of which are all non-management directors, recommended each of the above directors as a nominee for election at the Annual Meeting and inclusion on the Company’s proxy card.

Family Relationships

There are no family relationships among any of our officers or directors or director nominees.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors, director nominees, or executive officers have, during the past ten years, been involved in any legal proceedings described in subparagraph (f) of Item 401 of Regulation S-K. There are no material proceedings to which any director, director nominee, executive officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company.

Arrangements With Directors, Director Nominees, or Executive Officers

Our directors currently have terms which will end at our next annual meeting of the stockholders or until their successors are elected and qualified, subject to their prior death, resignation or removal. Officers serve at the discretion of the board of directors. There is no arrangement or understanding between any director, director nominee, or executive officer and any other person pursuant to which the director, director nominee, or executive officer was or is to be selected as a director, director nominee or officer.

Vote Required

Directors are elected by a plurality of the votes cast at the Annual Meeting. The six (6) nominees named in this proxy statement receiving the most “FOR” votes among votes properly cast electronically or by proxy will be elected to the Board as directors. You may vote “FOR” or “WITHHOLD” on each of the nominees for election as director. If you return a signed and dated proxy card and give no specific instruction but authorize us generally to vote your shares, your shares will be voted “FOR” the election of each of the six (6) nominees named in this proxy statement to the Board of Directors to hold office until the 2026 Annual Meeting.

Board Recommendation

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD SET FORTH IN THIS PROPOSAL NO. 1.

9

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR ENDING

DECEMBER 31, 2025

The Audit Committee of the Board (the “Audit Committee”) has selected CBIZ CPAs P.C. as the Company’s independent registered public accounting firm and principal accountant, to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2025. A representative of CBIZ CPAs P.C. will be present at the Annual Meeting and will have the opportunity to make a statement at the Annual Meeting if they desire to do so. Further, such representative will be available to respond to appropriate questions at the Annual Meeting.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Termination of BF Borgers CPA PC and Engagement of Marcum LLP

Effective May 13, 2024, with the approval of the Audit Committee, the Company dismissed BF Borgers CPA PC as its independent registered public accounting firm. On June 15, 2024, the Company engaged Marcum LLP as the Company’s new independent registered public accounting firm with the approval of the Audit Committee.

BF Borgers CPA PC’s audit reports on the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2023 and December 31, 2022 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles.

During the fiscal years ended December 31, 2023 and 2022, and the subsequent interim period through May 13, 2024, there were (i) no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and BF Borgers CPA PC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BF Borgers CPA PC, would have caused BF Borgers CPA PC to make reference to the subject matter of the disagreements in connection with its reports on the Company’s consolidated financial statements, and (ii) no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

The SEC has advised that, in lieu of obtaining a letter from BF Borgers CPA PC stating whether or not it agrees with the statements herein, the Company may indicate that BF Borgers CPA PC is not currently permitted to appear or practice before the SEC for reasons described in the SEC’s Order Instituting Public Administrative and Cease-and-Desist Proceedings Pursuant to Section 8A of the Securities Act of 1933, Sections 4C and 21C of the Securities Exchange Act of 1934 and Rule 102(e) of the Commission’s Rules of Practice, Making Findings, and Imposing Remedial Sanctions and a Cease-and-Desist Order, dated May 3, 2024.

During the fiscal years ended December 31, 2023 and 2023 and subsequently through June 15, 2024, neither the Company nor anyone on its behalf consulted with Marcum LLP on either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company by Marcum LLP that Marcum LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (2) any matter that was the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

Resignation of Marcum LLP and Engagement of CBIZ CPAs P.C.

On April 30, 2025, the Company was notified by Marcum LLP that Marcum LLP resigned as the Company’s independent registered public accounting firm. On November 1, 2024, CBIZ CPAs P.C. acquired the attest business of Marcum LLP. On April 30, 2025, with the approval of the Audit Committee, CBIZ CPAs P.C. was engaged as the Company’s independent registered public accounting firm.

10

Marcum LLP’s audit reports on the Company’s consolidated financial statements as of and for the years ended December 31, 2024 and 2023 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles.

During the fiscal years ended December 31, 2024 and 2023, and the subsequent period through April 30, 2025, there were (i) no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and Marcum LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum LLP, would have caused Marcum LLP to make reference to the subject matter of the disagreements in connection with its reports on the Company’s consolidated financial statements, and (ii) no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K), except for the material weaknesses in the Company’s internal control over financial reporting related to the proper design and implementation of certain controls, including: (1) control over formal review, approval, and evaluation of complex accounting transactions associated with business combinations; (2) controls over management’s formal review process that includes multiple levels of review as well as timely review of accounts and reconciliations leading to material adjustments; (3) controls over income tax provision and management’s review of the income tax provision; (4) controls over accounts receivable and unearned revenue, freight charges, and inventory and cost of sales accounts; (5) controls over the proper presentation and disclosure for related party transactions; and (6) information technology general controls related to access and change management controls that led to deficiencies in the design and operation of control activities, each as disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Company’s Annual Report on Form 10-K/A (Amendment No. 1) for the fiscal year ended December 31, 2023.

During the fiscal years ended December 31, 2024 and 2023 and through April 30, 2025, neither the Company nor anyone on its behalf consulted with CBIZ CPAs P.C. on either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company by CBIZ CPAs P.C. that CBIZ CPAs P.C. concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (2) any matter that was the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

The Company provided Marcum LLP with a copy of the foregoing disclosures that it was making in a Current Report on Form 8-K prior to its filing with the SEC and requested that Marcum LLP furnish the Company with a letter addressed to the SEC stating whether it agreed with the above statements made by the Company in response to Item 304(a) of Regulation S-K and, if it did not agree, the respects in which it did not agree. A copy of Marcum LLP’s letter, dated May 2, 2025, is filed as Exhibit 16.1 to the Current Report on Form 8-K filed by the Company with the SEC on May 2, 2025.

Principal Accountant Fees and Services

The aggregate fees billed to the Company by Marcum LLP as the Company’s principal accountant for the indicated services for each of the last two fiscal years were as follows:

| Year Ended | ||||||||

| December 31, | ||||||||

| 2024 | 2023 | |||||||

| Audit Fees | $ | 370,250 | $ | 225,000 | ||||

| Audit-Related Fees | — | — | ||||||

| Tax Fees | — | — | ||||||

| All Other Fees | — | — | ||||||

| Total | $ | 370,250 | $ | 225,000 | ||||

As used in the table above, the following terms have the meanings set forth below.

11

Audit Fees

Audit fees consist of aggregate fees billed for each of the last two fiscal years for professional services performed by the Company’s principal accountant for the audit of the financial statements included in our Annual Report on Form 10-K and review of the financial statements included in our Quarterly Reports on Form 10-Q, reviews of registration statements and issuances of consents, and services that are normally provided in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees

Audit-related fees consist of aggregate fees billed in each of the last two fiscal years for assurance and related services performed by the Company’s principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under the paragraph captioned “Audit-Fees” above. We did not engage our principal accountant to provide audit-related services during the last two fiscal years.

Tax Fees

Tax fees consist of aggregate fees billed in each of the last two fiscal years for professional services performed by the Company’s principal accountant with respect to tax compliance, tax advice, tax consulting and tax planning. We did not engage our principal accountant to provide tax compliance, tax advice or tax planning services during the last two fiscal years.

All Other Fees

All other fees consist of aggregate fees billed in each of the last two fiscal years for products and services provided by the Company’s principal accountant, other than for the services reported under the headings “Audit Fees,” “Audit-Related Fees” and “Tax Fees” above. We did not engage our principal accountant to render services to us during the last two fiscal years, other than as reported above.

Pre-Approval Policies and Procedures

The Audit Committee has reviewed and approved all fees earned in 2024 and 2023 by the Company’s principal accountant with respect to these years, and actively monitored the relationship between audit and non-audit services provided. The Audit Committee has concluded that the fees earned by the principal accountant with respect to these years were consistent with the maintenance of the principal accountant ’s independence in the conduct of its auditing functions.

None of the services described in “—Audit-Related Fees” above for 2023 were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

The Audit Committee annually considers the provision of audit services. The Audit Committee must pre-approve all services provided and fees earned by the Company’s principal accountant. The Audit Committee has established pre-approval policies and procedures that are detailed as to the particular service, that require that the Audit committee be informed of each service, and that do not include delegation of the Audit Committee’s responsibilities under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to management. The pre-approval policies and procedures provide only for defined audit services and, if any, specified audit-related fees, tax services, and other services, and may impose specific dollar value limits for the fees for pre-approved services. The Audit Committee also considers on a case-by-case basis specific engagements that are not otherwise pre-approved under the pre-approval policies and procedures or that materially exceed pre-approved fee amounts. On an interim basis, any proposed engagement that does not fit within the definition of a pre-approved service may be presented to a designated member of the Audit Committee for approval and to the full Audit Committee at its next regular meeting.

The percentage of hours expended on the Company’s principal accountant ’s engagement to audit the Company’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant ’s full-time, permanent employees was not greater than 50%.

12

Vote Required

Ratification of CBIZ CPAs P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 requires the majority of the voting power of a quorum (meaning the number of shares of common stock voted “FOR” this proposal must exceed the number of shares of common stock voted “AGAINST” or “ABSTAIN” as to this proposal). Abstentions will have the same effect on this proposal as a vote “AGAINST”. There will be no broker “non-votes” for this proposal because brokers have discretion to vote the shares held for the beneficial owners. You may vote “FOR”, “AGAINST”, or “ABSTAIN” on this proposal. If you return a signed and dated proxy card and give no specific instruction but authorize us generally to vote your shares, your shares will be voted “FOR” this proposal.

The selection of our independent registered public accounting firm is not required to be submitted to a vote of our stockholders for ratification. However, we are submitting this matter to the stockholders as a matter of good corporate governance. Even if the appointment is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of us and our stockholders. If the appointment is not ratified, the Audit Committee will reconsider whether or not to retain CBIZ CPAs P.C.

Board Recommendation

THE BOARD RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF CBIZ CPAS P.C. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2025.

AUDIT COMMITTEE REPORT

The following Audit Committee Report shall not be deemed to be “soliciting material,” deemed “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate by reference future filings, including this proxy statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filings.

In the performance of its oversight function, the Audit Committee has:

| ● | reviewed and discussed with management the Company’s annual audited financial statements for the fiscal year ended December 31, 2024; |

| ● | discussed with Marcum LLP, the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC; |

| ● | received from Marcum LLP, the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024, the written disclosures and the letter required by applicable requirements of the PCAOB regarding the prior independent registered public accounting firm’s communication with the Audit Committee concerning independence; and |

| ● | discussed with Marcum LLP, the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024, its independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements for the fiscal year ended December 31, 2024 be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 for filing with the SEC.

| Submitted by the Audit Committee | |

| Brian M. Posner, Chairman | |

| Sarah L. Cummins | |

| Mark Charles Adams |

13

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Securities Ownership of Certain Beneficial Owners, Management, and Director Nominees

The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of the close of business on July 9, 2025 for: (i) each of our named executive officers, other executive officers, directors, and director nominees; (ii) all of our executive officers and directors as a group; and (iii) each person known by us to beneficially own more than 5% of any class of our voting securities.

| Title of Class | Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Percent of Class (%)(3) | |||||||

| Common Stock | Andrew Shape, President, Chief Executive Officer, Director, and Director Nominee | 3,720,571 | (4) | 19.8 | ||||||

| Common Stock | David Browner, Chief Financial Officer | 78,000 | (5) | 0.4 | ||||||

| Common Stock | Andrew Stranberg, Executive Chairman, Secretary, Treasurer, Director, and Director Nominee | 5,541,190.143 | (6) | 29.3 | ||||||

| Common Stock | John Audibert, Vice President of Growth and Strategic Initiatives | 193,250 | (7) | 1.0 | ||||||

| Common Stock | Ian Wall, Chief Information Officer | 10,000 | (8) | * | ||||||

| Common Stock | Alan Chippindale, Director and Director Nominee | 15,892 | (9) | * | ||||||

| Common Stock | Sarah L. Cummins, Director and Director Nominee | 32,492 | * | |||||||

| Common Stock | Brian M. Posner, Director and Director Nominee | 8,904 | * | |||||||

| Common Stock | Mark Charles Adams, Director and Director Nominee | 9,449 | * | |||||||

| Common Stock | All directors and executive officers (9 persons) | 9,609,748.143 | 49.6 | |||||||

| * | A percentage of shares beneficially owned by a director of the Company that does not exceed one percent of the outstanding shares of common stock as of July 9, 2025. |

| (1) | Unless otherwise specified, the address of each of the persons named in this table is c/o Stran & Company, Inc., 500 Victory Road, Suite 301, Quincy, MA 02171. |

| (2) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Under those rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power, and also any shares which the person has the right to acquire within 60 days of July 9, 2025, through the exercise or conversion of any stock option, convertible security, warrant or other right. Except as set forth below, each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of our common stock. |

| (3) | Based on 18,528,443 shares of common stock issued and outstanding as of July 9, 2025. For each beneficial owner above, any shares which the person has the right to acquire within 60 days of July 9, 2025, through the exercise or conversion of any stock option, convertible security, warrant or other right, have been included in the denominator upon which the percentage is based. |

| (4) | Consisted of 3,417,000 shares of common stock and 303,571 shares of common stock issuable upon exercise of an option within 60 days of July 9, 2025. 3,400,000 of the shares of common stock are pledged as a security interest pursuant to a purchase money promissory note issued to Andrew Stranberg as collateral for Andrew Shape’s repayment obligations under this instrument. Mr. Shape may sell these shares subject to the security interest at prevailing market prices so long as such portion of the sale proceeds as is required under the promissory note to repay the note is so used to repay the note. |

14

| (5) | Consisted of (i) 12,500 shares of common stock and (ii) 65,500 shares of common stock issuable upon exercise of options. |

| (6) | Consisted of 5,166,190.143 shares of common stock and 375,000 shares of common stock issuable upon exercise of an option within 60 days of July 9, 2025. |

| (7) | Consisted of (i) 112,750 shares of common stock and (ii) 80,500 shares of common stock issuable upon exercise of options within 60 days of July 9, 2025. |

| (8) | Consisted of 10,000 shares of common stock issuable upon exercise of an option within 60 days of July 9, 2025. |

| (9) | Consisted of (i) 10,892 shares of common stock and (ii) 5,000 shares of common stock issuable upon exercise of an option. |

Changes in Control

We do not have any arrangements known to us the operation of which may at a subsequent date result in a change in control of the Company.

15

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

During the year ended December 31, 2024:

| ● | the Board held four meetings; |

| ● | the Audit Committee held two meeting; |

| ● | the Compensation Committee of the Board (the “Compensation Committee”) held one meeting; and |

| ● | the Nominating and Corporate Governance Committee did not held any meetings. |

During the year ended December 31, 2024, each member of the Board attended at least 75% of the aggregate of the total number of meetings of the Board (held during the period for which he or she has been a director) and the total number of meetings held by all committees of the Board on which he or she served (during the periods that he or she served).

We do not have a policy requiring Board members to attend the annual meeting of our stockholders. All members of the Board at the time of our 2023 annual meeting of stockholders attended our 2023 annual meeting of stockholders. We did not hold an annual meeting of stockholders during 2024.

Independent Directors and Director Nominees

The rules of The Nasdaq Stock Market LLC (“Nasdaq”) generally require that a majority of an issuer’s board of directors consist of independent directors. The Board of Directors consists of six directors, four of whom, consisting of Mark Charles Adams, Alan Chippindale, Sarah L. Cummins, and Brian M. Posner, have been determined by the Board to be “independent directors” within the meaning of Nasdaq Listing Rule 5605(a)(2). For a discussion of certain considerations relating to certain transactions in which Alan Chippindale or Sarah L. Cummins has had an interest, see “—Transactions with Related Persons – Transactions with Non-Employee Director Affiliates”. For discussion of compensation and indemnification arrangements with our independent directors for services performed as members of the Board, see “Executive Compensation – Director Compensation”.

Governance Structure

We chose to appoint a separate chairman of the Board, which we generally refer to as our Executive Chairman, who is not our Chief Executive Officer. The Company determined that a separate chairman of the Board can act as a balance to the Chief Executive Officer, who also serves as a non-independent director. However, the Bylaws provide the Board with the flexibility to combine or separate the positions of chairman of the Board and Chief Executive Officer. Andrew Stranberg currently serves as our Executive Chairman and Andrew Shape currently serves as our Chief Executive Officer. We do not currently intend to combine these positions; however, a change in this leadership structure could be made if the Board determines it is in the best long-term interests of stockholders. For example, if the two roles were to be combined, we believe that the independence of the majority of our directors, and the three fully independent Board committees, would provide effective oversight of our management and the Company.

The Board’s Role in Risk Oversight

The Board and its committees oversee risk management so that the assets of the Company are properly safeguarded, that the appropriate financial and other controls are maintained, and that our business is conducted wisely and in compliance with applicable laws and regulations and proper governance. Included in these responsibilities is the Board’s oversight of the various risks facing the Company. In this regard, the Board seeks to understand and oversee critical business risks. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of our business strategy. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk-taking is essential for the Company to be competitive on a global basis and to achieve its objectives.

16

While the Board oversees risk management, Company management is charged with managing risk. Management communicates routinely with the Board and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management.

The Board administers its risk oversight function as a whole by making risk oversight a matter of collective consideration. Much of this work has been delegated to committees, which will meet regularly and report back to the full Board. The Audit Committee oversees risks related to our financial statements, the financial reporting process, accounting and legal matters. The Compensation Committee evaluates the risks and rewards associated with our compensation philosophy and programs. The Nominating and Corporate Governance Committee evaluates risk associated with management decisions and strategic direction. The Disclosure Controls and Procedures Committee of the Board (the “Disclosure Controls and Procedures Committee”) assists as needed in assessing risks relevant to achieving the goal of accurate and timely disclosure, forming a basis for determining how the risks should be managed.

Board Committees

The Board has established the Audit Committee in accordance with Section 3(a)(58)(A) of the Exchange Act; the Compensation Committee; the Nominating and Corporate Governance Committee; and the Disclosure Controls and Procedures Committee. All committees operate under a written charter adopted by the Board, each of which is available on our Internet website at https://ir.stran.com.

In addition, the Board may, from time to time, designate one or more additional committees, which shall have the duties and powers granted to it by the Board.

Audit Committee

The Audit Committee is responsible for, among other things: (i) the integrity of the Company’s financial statements and financial reporting process and the Company’s systems of internal accounting and financial controls, (ii) the performance of the internal and external audit services function, (iii) the annual independent audit of the Company’s financial statements, the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance, (iv) the compliance by the Company with legal and regulatory requirements, including the Company’s disclosure controls and procedures, (v) the conduct of and compliance by the Company’s officers and directors with the Company’s Code of Ethics and Business Conduct (the “Code of Ethics”), (vi) the evaluation of enterprise risk issues, (vii) the preparation of the Audit Committee Report that is required pursuant to the rules of the SEC, and (viii) the fulfillment of the other responsibilities set out in its charter.

The Audit Committee’s members are Mark Charles Adams, Sarah L. Cummins, and Brian M. Posner, with Mr. Posner serving as the chairman. The Board has determined that each of the Audit Committee’s members meets the definition of an “independent director” as defined under Nasdaq Listing Rule 5605(a)(2), meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act, and meets the other requirements for Audit Committee membership under Nasdaq Listing Rule 5605(c)(2). In making this determination with respect to Ms. Cummins, the Board considered the transactions described under “Certain Relationships and Related Transactions – Transactions with Non-Employee Director Affiliates – Transactions with Kapstone Partners, LLC (Sarah L. Cummins)”. In addition, the Board has determined that Mr. Posner qualifies as an “audit committee financial expert” as defined by Item 407(d)(5) of Regulation S-K.

Compensation Committee

The Compensation Committee is responsible for, among other things: (i) reviewing and approving the remuneration of our executive officers; (ii) evaluating and making recommendations to the Board regarding the compensation of our independent directors; (iii) evaluating and making recommendations to the Board regarding equity-based and incentive compensation plans, policies and programs; and (iv) the fulfillment of the other responsibilities set out in its charter.

17

The Compensation Committee has the authority to evaluate the performance of the Chief Executive Officer, or person performing an equivalent function, and, either as a committee or together with the other independent directors (as directed by the Board), determine and approve the compensation of the Chief Executive Officer, or person performing an equivalent function, based on this evaluation. The Chief Executive Officer, or person performing an equivalent function, may not be present during voting or deliberations on his or her compensation. In addition, upon the engagement of and annually thereafter, the Compensation Committee has the authority to determine and approve the compensation paid to the Company’s Chief Financial Officer, or person performing an equivalent function, and any other executive officers that serve in executive officer capacities for the Company. The Compensation Committee must approve all long-term incentive awards for the executive officers of the Company. The Compensation Committee may make factual determinations concerning any equity incentive plan.

The Compensation Committee may retain a compensation consultant, independent legal counsel or other adviser. During the fiscal year ended December 31, 2024, the Compensation Committee did not retain any compensation consultant, independent legal counsel or other adviser.

The Compensation Committee may grant the right to receive indemnification and right to be paid by the Company the expenses incurred in defending any proceeding in advance to its disposition, to any employees in their capacity as officer, director, employee or agent of the Company, any of the directors of the Company and any of the Company’s executive officers to the fullest extent of the provisions of the Bylaws.

In addition, the Compensation Committee may use reasonable amounts of time of the Company’s independent accountants, outside lawyers and other internal staff to assist and advise the Committee in connection with its responsibilities. The Committee must keep the Company’s Chief Financial Officer, or person performing an equivalent function, informed as to the general range of anticipated expenses for outside consultants.

The Compensation Committee also periodically evaluates and makes recommendations to the Board concerning the total compensation package for directors, including fees, reimbursable expenses, and equity compensation.

The Compensation Committee’s members are Mark Charles Adams, Alan Chippindale, and Sarah L. Cummins, with Mr. Chippindale serving as the chairman. The Board has determined that each of the Compensation Committee’s members satisfies the “independence” requirements of Nasdaq Listing Rule 5605(d)(2)(A). In making this determination with respect to Mr. Chippindale and Ms. Cummins, the Board considered the transactions described under “Certain Relationships and Related Transactions – Transactions with Non-Employee Director Affiliates – Transactions with Engage and Excel (Alan Chippindale)” and “Certain Relationships and Related Transactions – Transactions with Non-Employee Director Affiliates – Transactions with Kapstone Partners, LLC (Sarah L. Cummins)”, respectively.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for, among other things: (i) identifying and evaluating individuals qualified to become members of the Board by reviewing nominees for election to the Board submitted by stockholders and recommending to the Board director nominees for each annual meeting of stockholders and for election to fill any vacancies on the Board; (ii) advising the Board with respect to Board organization, desired qualifications of Board members, the membership, function, operation, structure and composition of committees (including any committee authority to delegate to subcommittees), and self-evaluation and policies; (iii) advising on matters relating to corporate governance and monitoring developments in the law and practice of corporate governance; and (iv) approving any related-party transactions.

The Nominating and Corporate Governance Committee’s methods for identifying candidates for election to the Board (other than those proposed by our stockholders, as discussed below) will include the solicitation of ideas for possible candidates from a number of sources, including members of the Board, our executives, individuals personally known to the members of the Board, and other research. The Nominating and Corporate Governance Committee may also, from time to time, retain one or more third-party search firms to identify suitable candidates.

18

In making director recommendations, the Nominating and Corporate Governance Committee may consider some or all of the following factors: (i) the candidate’s judgment, skill, experience with other organizations of comparable purpose, complexity and size, and subject to similar legal restrictions and oversight; (ii) the interplay of the candidate’s experience with the experience of other Board members; (iii) the extent to which the candidate would be a desirable addition to the Board and any committee thereof; (iv) whether or not the person has any relationships that might impair his or her independence; and (v) the candidate’s ability to contribute to the effective management of the Company, taking into account the needs of the Company and such factors as the individual’s experience, perspective, skills and knowledge of the industry in which we operate.

The Nominating and Corporate Governance Committee’s members are Mark Charles Adams, Alan Chippindale, and Brian M. Posner, with Mr. Adams serving as the chairman. As noted above, the Board has determined that the Nominating and Corporate Governance Committee is comprised solely of “independent directors” as such term is defined by Nasdaq Listing Rule 5605(a)(2). In making this determination with respect to Mr. Chippindale, the Board considered the transactions described under “Certain Relationships and Related Transactions – Transactions with Non-Employee Director Affiliates – Transactions with Engage and Excel (Alan Chippindale)”.

Disclosure Controls and Procedures Committee

The Disclosure Controls and Procedures Committee is responsible for, among other things: (i) the identification and disclosure of material information about the Company; (ii) the accuracy, completeness and timeliness of the Company’s financial reports under the Exchange Act and the listing rules of Nasdaq; (iii) the review and, as necessary, help with the revision of the Company’s controls and other procedures; (iv) assistance with documenting, and monitoring the integrity and evaluating the effectiveness of, the Company’s disclosure controls and procedures; and (v) review of the Company’s reports filed with the SEC, press releases containing financial information or other information material to the Company’s security holders.

The Disclosure Controls and Procedures Committee’s members are comprised of the Company’s officers and directors. David Browner, the Company’s Chief Financial Officer, acts as the chairman of the Disclosure Controls and Procedures Committee. The Company’s officers and directors may assume any or all of the responsibilities of the Disclosure Controls and Procedures Committee at any time.

Director Nominations

Criteria for Board Membership

The Nominating and Corporate Governance Committee is responsible for periodically evaluating the desirability of and recommending to the Board any changes in the size and composition of the Board or the qualifications for Board membership. In making its recommendations to the Board, the Nominating and Corporate Governance Committee considers, evaluates and selects directors, including nominees recommended by stockholders, in accordance with the following general and specific considerations:

| ● | General Considerations. The Nominating and Corporate Governance Committee must ensure that the Board is comprised of at least enough independent directors to comply with the requirements of Nasdaq as well as applicable rules and regulations of the SEC. In making its recommendations, the Committee may consider some or all of the following factors: (1) The candidate’s judgment, skill, experience with other organizations of comparable purpose, complexity and size, and subject to similar legal restrictions and oversight; (2) The interplay of the candidate’s experience with the experience of other Board members; (3) The extent to which the candidate would be a desirable addition to the Board and any committee thereof; (4) Whether or not the person has any relationships that might impair his or her independence, including, but not limited to, business, financial or family relationships with the Company’s management; and (5) The candidate’s ability to contribute to the effective management of the Company, taking into account the needs of the Company and such factors as the individual’s experience, perspective, skills and knowledge of the industries in which the Company operates. |

19

| ● | Specific Considerations. In addition to the foregoing general considerations, the Nominating and Corporate Governance Committee will develop, reevaluate at least annually and modify as appropriate a set of specific considerations outlining the skills, experiences (whether in business or in other areas such as public service, academia or scientific communities), particular areas of expertise, specific backgrounds, and other characteristics for which there is a specific need on the Board and which would enhance the effectiveness of the Board and its committees given its current composition. |

The Nominating and Corporate Governance Committee will evaluate each new director candidate and each incumbent director before recommending that the Board nominate such individual for election (or that the Board elect such individual on an interim basis) as a director based upon the extent to which such individual satisfies the general criteria above and will contribute significantly to satisfying the overall mix of specific criteria identified above. Each annual decision to nominate an incumbent director must be based upon a careful consideration of such individual’s contributions, including the value of the person’s experience as a director of the Company, the availability of new director candidates who may offer unique contributions and the Company’s changing needs.

The Nominating and Corporate Governance Committee will seek to identify potential director candidates who will strengthen the Board and will contribute to the overall mix of considerations identified above. This process should include establishing procedures for soliciting and reviewing potential nominees from directors and stockholders and for notifying those who suggest nominees of the outcome of such review. The Nominating and Corporate Governance Committee will have sole authority to retain and terminate any third-party search firms to be used to identify director candidates, including sole authority to approve any such search firm’s fees and other terms of retention.